oregon workers benefit fund tax rate

The WBF is funded by cents-per-hour assessments on both. Employers use Forms OQ and OTC to.

Workers Compensation Overview And Issues Everycrsreport Com

For 2022 the rate is 22 cents per hour.

. You are responsible for any. NE Salem Oregon 97301. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged.

In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment. Oregon workers compensation costs already among the lowest in the nation will drop in 2022 for the ninth-straight year. The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to each employee.

In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment. These coronavirus stimulus checks from Oregon however would go only to low-income workers. The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers owners and officers covered by workers compensation.

Oregon workers benefit fund tax rate Saturday June 18 2022 Edit. You are responsible for any. Color-coded maps of the US.

Oregon workers are subject to Workers Benefit Fund WBF assessment tax. For 2019 our analysts. Workers Benefit Fund Assessment Rate Workers Benefit Fund cents-per-hour assessment.

The workers benefit fund assessment rate will be 22 cents per hour in 2023. The Oregon workers compensation payroll assessment rate will not change in 2023. Oregon Workers Benefit Fund Payroll Tax Overview.

Employers and employees split this assessment. Prescribe the rate of the Workers Benefit Fund assessment under. Go online at httpswww.

Benefits paid from the Workers Benefit Fund. 653026 Nonurban county defined for ORS. What is the Oregon WBF tax rate.

Oregon Workers Benefit Fund Payroll Tax Overview. Prescribe the rate of the Workers Benefit Fund assessment under ORS 656506. 10 12 22 24 32 35 and 37.

Oregon Workers Benefit Fund Payroll Tax Overview. There are seven federal tax brackets for the 2021 tax year. You are responsible for any.

In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment. The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers. Oregon has several benefit programs that are paid from the Workers Benefit Fund.

Workers Benefit Fund Assessment Oregon Administrative Rules Chapter 436 Division 070 Effective Jan. The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled and gives benefits to. Your bracket depends on your taxable incomeAmong other requirements you must live.

Workers Benefit Fund - Oregon. This assessment is calculated based on employees per hour worked. 3 Workers Benefit Fund WBF Assessment Important information The 2022 Workers Benefit Fund WBF assessment rate is 22 cents per hour.

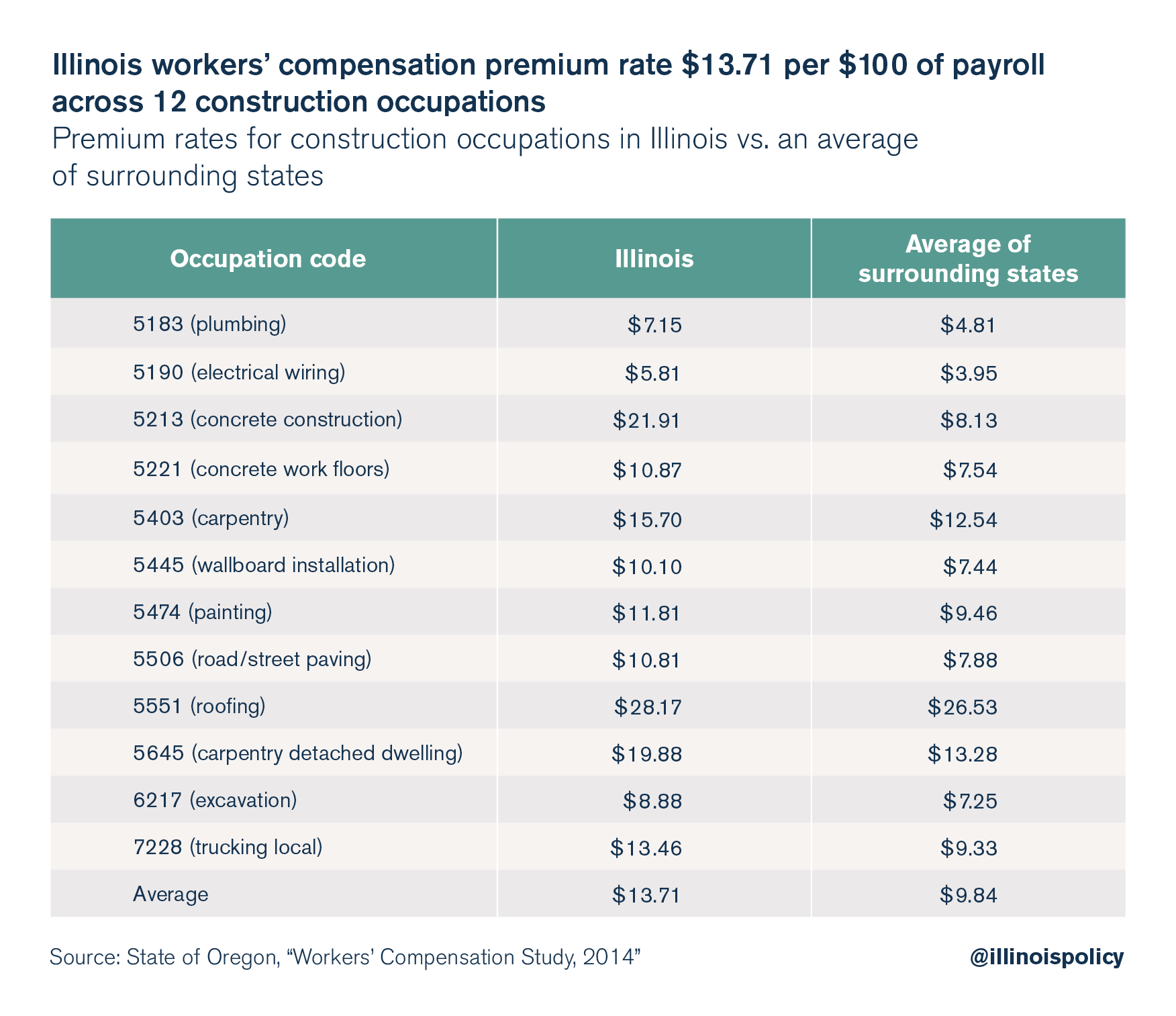

The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers. Ranking of each states workers.

Oregon S Nonresident Workers Article Display Content Qualityinfo

Workers Compensation Rates In Oregon

Workers Compensation Emerging Issues Analysis Lexisnexis Store

Benefit Adequacy In State Workers Compensation Programs

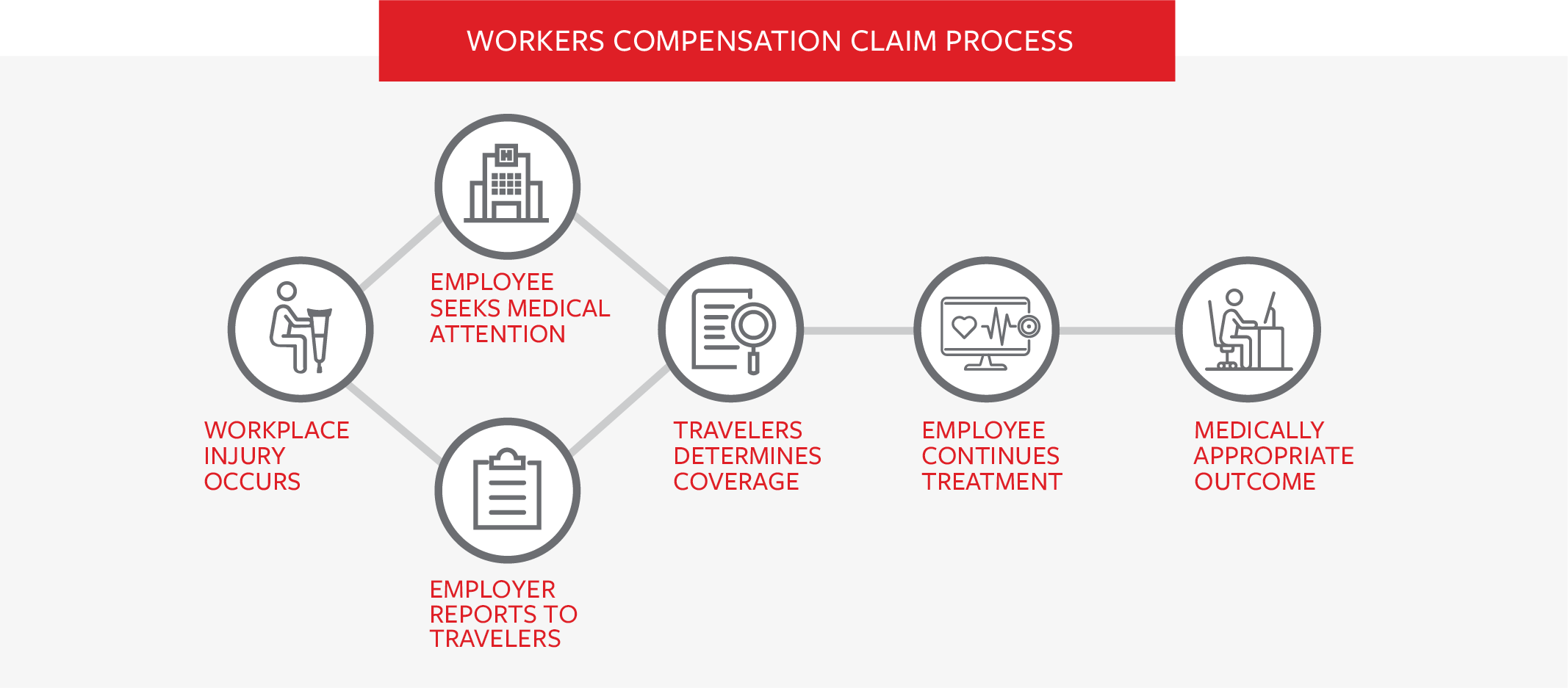

Workers Compensation Resources Travelers Insurance

Budgeting For 2022 A Production Accountant S Guide Entertainment Partners

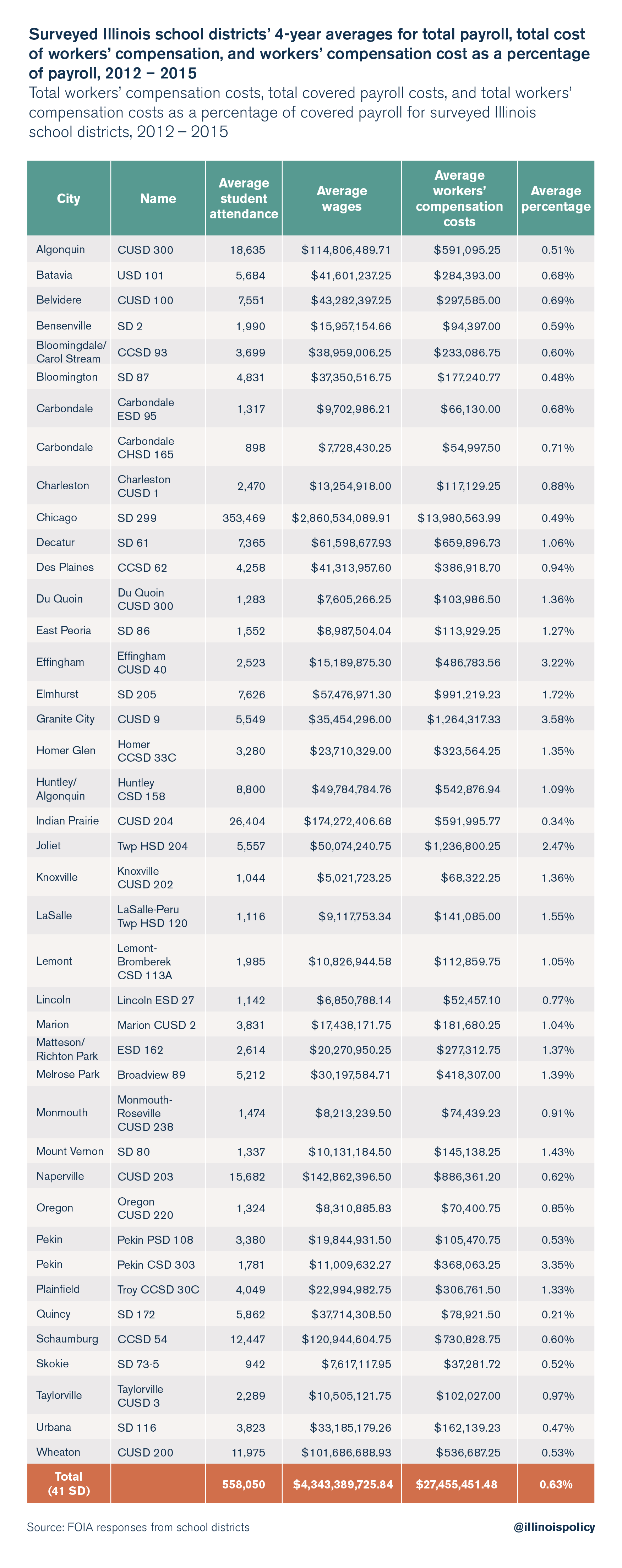

Workers Compensation Estimated To Cost Illinois Taxpayers Nearly 1 Billion Per Year Illinois Policy

Oregon Workers Benefit Fund Payroll Tax

Workers Comp Or Disability Which Is Better Kbg Injury Law

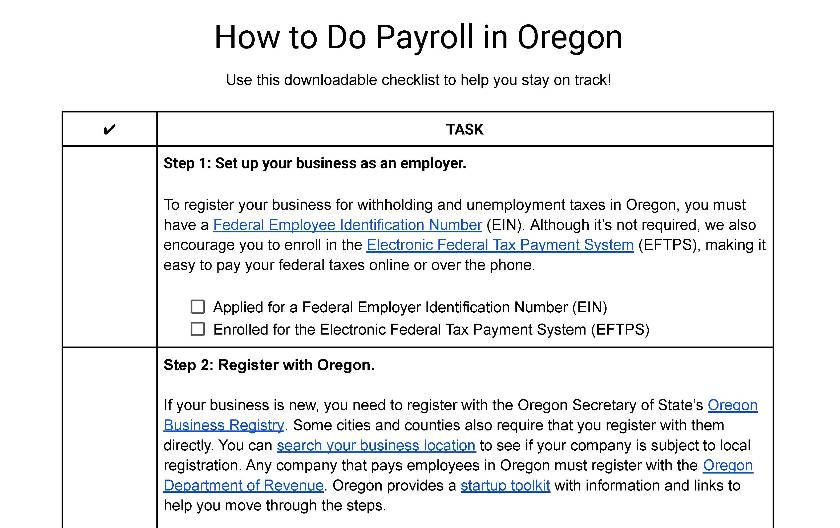

How To Do Payroll In Oregon What Employers Need To Know

Oregon Labor Laws The Complete Guide For 2022

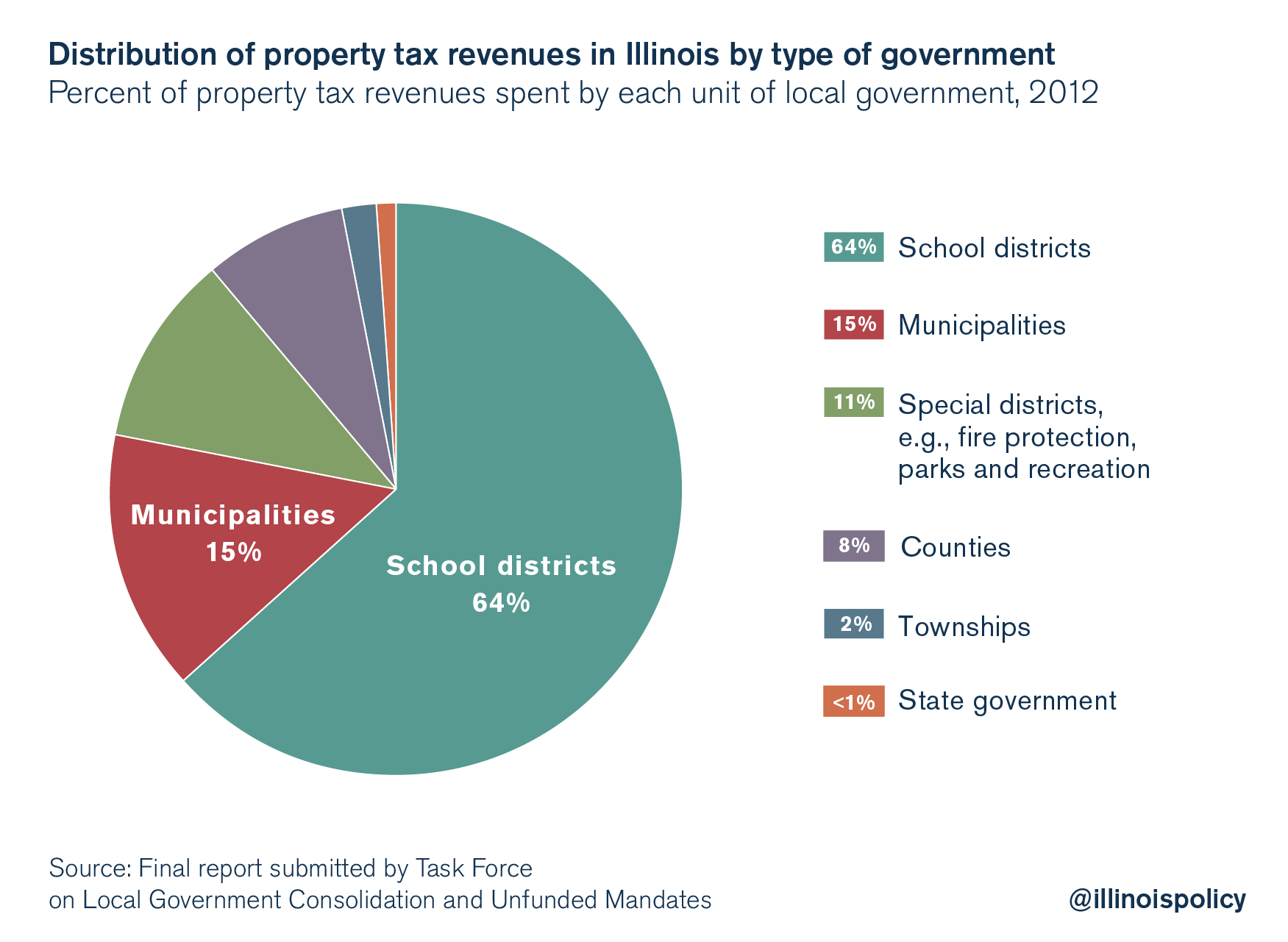

Workers Compensation Estimated To Cost Illinois Taxpayers Nearly 1 Billion Per Year Illinois Policy

The True Cost Of Paying An Employee Article

Workers Compensation Estimated To Cost Illinois Taxpayers Nearly 1 Billion Per Year Illinois Policy

Workers Compensation Death Benefits By State Interactive Map

Workers Compensation State By State Information

5 Common Questions About Oregon Workers Compensation Answered

Oregon Household Employment Tax And Labor Law Guide Care Com Homepay